Utility Sales Tax 101

It Pays to be Orange - The Utility Sales Tax Exemption

it pays to be orange

There are significant potential savings for the consumption of energy used in the manufacturing and production process. In this article, we will explore the savings opportunity, how to obtain the exemption, and why it’s important to work with a firm who has experience in these tax exemptions.

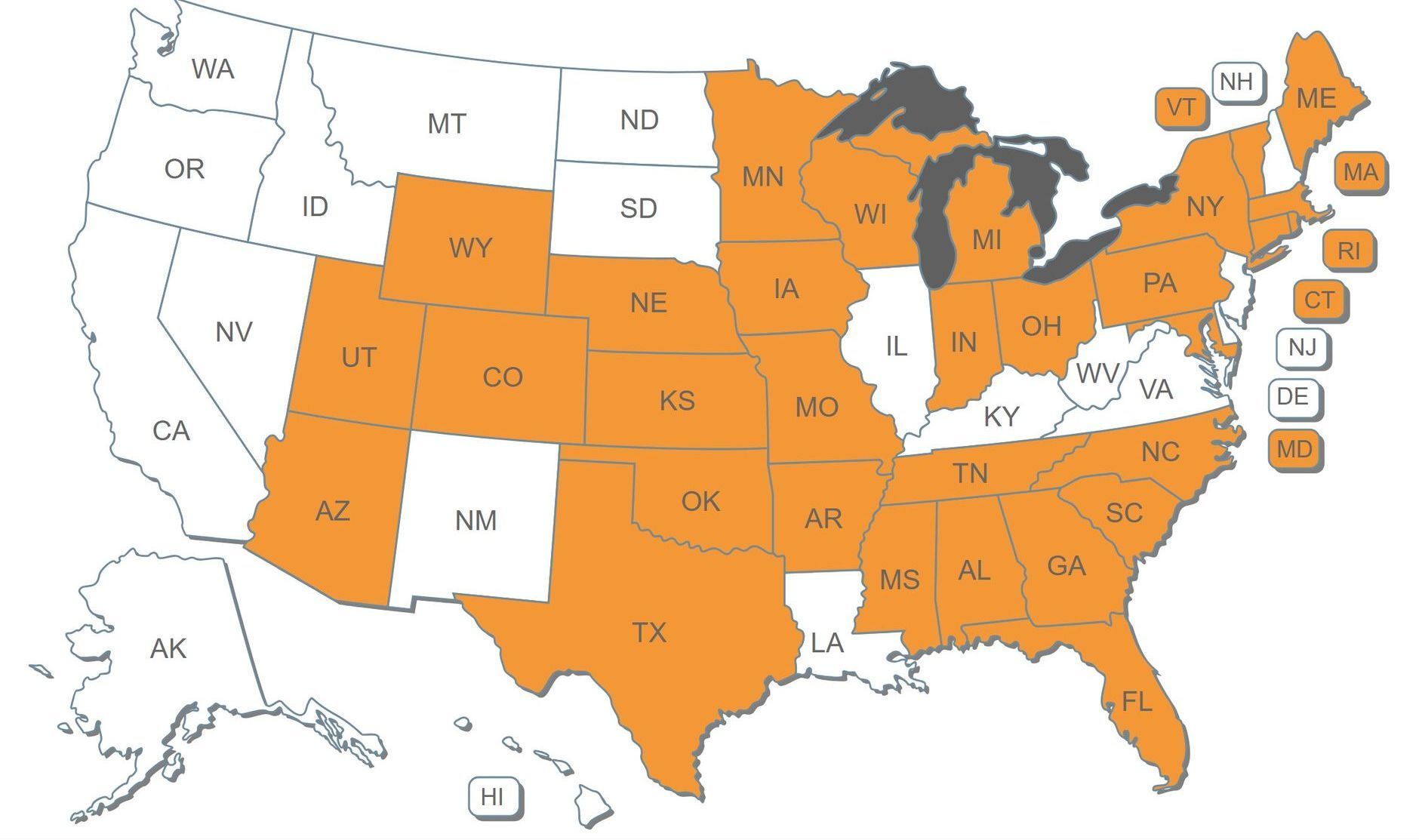

In 31 States (those highlighted in orange), when your utilities are “necessary and integral to production” you do not have to pay sales tax on those utilities. The utility sales tax exemption is legislation that is used as an economic incentive to encourage manufacturing and production within the State. Manufacturers are entitled to this utility sales tax exemption, and it could save your company substantial tax dollars moving forward.

In order to obtain utility sales tax exemptions, Align specializes in performing the required engineering studies on applicable utility meters. This creates an immediate and permanent savings on utility bills each month. Additionally, retroactive studies can be performed to recover all utility sales taxes paid on the meter going back 36-48 months depending on the State. Depending on the size of the utility bills, this can be a considerable amount of savings for a manufacturer.

Industries that typically qualify for the utility sales tax exemption include:

- Manufacturers

- Breweries, Wineries & Distilleries

- Industrial Processors

- Recyclers

- Fabricators

- R&D Facilities

- Data Centers

- Agriculture/Farming

- Mining Facilities

- Restaurants (in Indiana, Iowa, Kansas, Ohio)

- Not-for-profit Organizations (in select states)

Eligibility

The utility sales tax exemption is available in 31 States (see map). The exemption applies when utilities are recognized as necessary and integral to a business’s production process. Exempt utilities typically include electricity, gas, and water. It's important to note that rules and regulations regarding this exemption vary from State to State.

Our team stays current on each State’s tax legislation, and we are here to guide your company through the process to ensure you receive any and all available exemptions.

How to obtain the exemption

To qualify for this tax exemption, businesses must conduct an engineering study on their applicable utility meters. The meter engineering study identifies the exact percentage of utility consumption that qualifies for the exemption. Once the exemption applications are submitted, businesses can expect utility sales tax payments to be completely eliminated or greatly reduced.

At Align, expertise matters

The meter engineering study is the most important piece in the process. The State DOR’s expect a very thorough and detailed report. If the State’s find any flaws or errors in the calculations, they will deny the application. Determining which portion of utility consumption qualifies for the exemption can be complex. It is important to engage an experienced firm to audit the utility usage in the manufacturing and production process. Align has been filing utility sales tax exemptions for nearly 20 years. Our experts will conduct a meter engineering study to determine the exact percentage that the utilities are being used in the manufacturing process. We gather information on the production process, hours, number of shifts, machinery & equipment, and facility size in order to come up with the exact percentage of the utility being used in process. Our team will also work with state and local officials to file and support the results of a study.

Next steps

If your company fits into one of the categories listed above, you should consider this tax exemption for your business. It would produce substantial savings and refunds. Also consider this exemption during significant business events, such as mergers & acquisitions, expansions, or selecting a new utility vendor. Contact one of our experts to assess whether this exemption may be an opportunity for your business.