The One Big Beautiful Bill Could Unlock Major Tax Credits - Are You Ready?

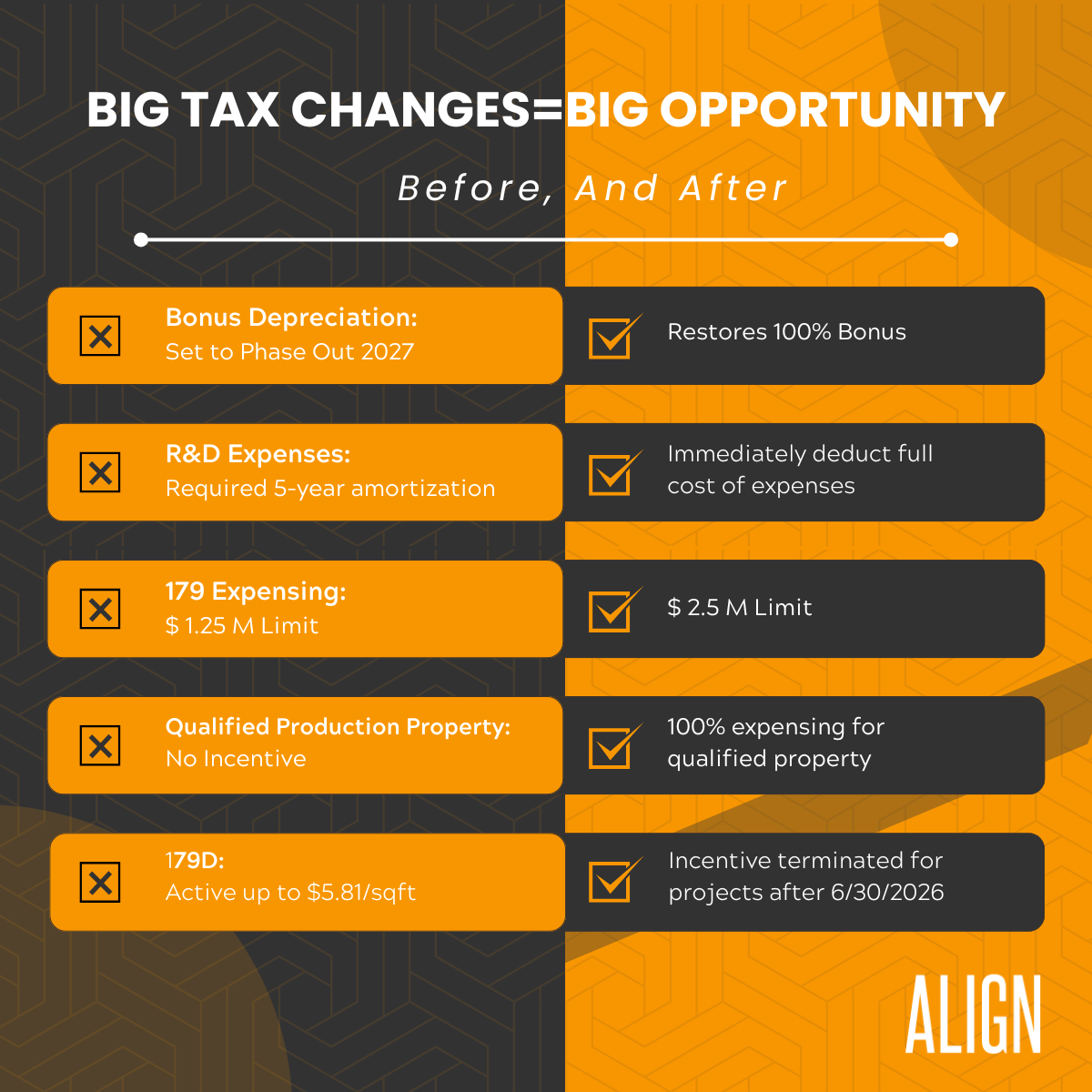

Big Tax Changes = Big Opportunities

On July 4th, the One Big Beautiful Bill Act was signed into law, delivering sweeping changes to the tax code. These reforms carry major implications for real estate investors, manufacturers, and businesses investing in R&D. Several taxpayer-friendly incentives were introduced (or restored), while many green energy tax breaks were repealed.

Below is a high-level summary of the provisions that matter most and how they can impact your business:

100% Bonus Depreciation is Permanent

- Qualified property acquired on or after January 19, 2025, is now eligible for 100% bonus depreciation. Previously, bonus depreciation was set to phase out by 2027.

- Businesses and real estate investors can immediately deduct the full cost of qualified property, which can be maximized via a cost segregation study.

Why it matters:

- Building components like lighting, flooring, HVAC systems, and landscaping can be reclassified to 5-, 7-, or 15-year property and deducted immediately.

- A cost segregation study can maximize these deductions, which creates opportunity for significant year-one cash flow and reducing tax liability.

Research and Development Expenses

- Starting with tax years after December 31, 2024, domestic R&D expenses can again be fully deducted in the year incurred. Previously, a 5-year amortization was required. This change has also been made permanent.

- Retroactive relief is also available:

- Businesses may fully deduct remaining unamortized R&D expenses from 2022–2024 in either 2025 or over 2025–2026.

- Small businesses with $31 million in revenue or less may qualify for additional retroactive relief.

Why it matters:

- The R&D credit regains its full value, no longer diminished by R&D expense amortization.

- This encourages investment in U.S.-based innovation, as foreign R&D expenses must still be amortized over 15 years.

Section 179 Expense Increase

- The Section 179 deduction has increased from $1.25M to $2.5M, with a dollar-for-dollar phaseout starting at $4M for qualifying property placed into service after December 31st, 2024.

Why it matters:

- Provides greater flexibility to expense eligible property, including items such as HVAC equipment and roofing expenditures that are not eligible for bonus depreciation.

- Most states conform to Section 179, offering potential state and federal tax savings.

Qualified Production Property Bonus Eligibility

- A temporary 100% special depreciation allowance that applies to nonresidential real property used in qualified production activities that are defined as manufacturing, production, or refining.

- Eligible projects include the following guidelines:

- Must be used in the U.S. or a U.S. territory

- The original use must be used with the taxpayer

- Construction must start after December 31st, 2024 and before January 1st, 2030

- Property must be placed into service by January 1st, 2034

- The taxpayer must elect to claim the immediate deduction of the property.

- Certain activities such as administrative services, sales, research and software development do not qualify.

Why it matters:

- The first incentive of its kind applies to building structures being eligible for a 100% special depreciation allowance.

- A cost segregation study can help identify and separate qualified property from non-qualified property.

Section 179D Elimination

- The 179D energy efficiency deduction, which was up to $5.81/sq ft will be terminated. Projects starting after June 30, 2026, will no longer qualify.

Why it matters:

- Businesses relying on 179D will need to explore alternative tax strategies to offset income.

- Timing is key for projects soon to start construction to take advantage of the incentive.

Takeaways for Business Owners:

- Real estate investors should revisit any capital improvements or purchases since January 2025 and consider a cost segregation study to maximize immediate deductions.

- Innovative businesses with domestic R&D should prepare to claim full expensing and the R&D credit, even for earlier years if eligible.

- Work with a specialty tax advisor to assess whether you qualify for retroactive adjustments and how to utilize and comply with the new rules.

These changes represent a rare window of opportunity for businesses to reclaim past tax dollars and accelerate future savings. Whether you build, manufacture, or innovate, now is the time to revisit your tax strategy!

Need help navigating these new rules or identifying opportunities?

Email us or fill out our brief contact form at the link below: