Utilizing Tax Benefits for Multifamily Investors

Multifamily properties are a fantastic option for investors seeking steady cash flow, high valuation potential, and passive income.

However, investing in multifamily properties often requires large upfront investments and can cause cash flow issues for investors, especially if there are many repairs and improvements that an existing property needs. Luckily, savvy investors can utilize tax strategies such as cost segregation to lower taxable income, increase cash flow, and create opportunities for future tax savings.

What is Cost Segregation?

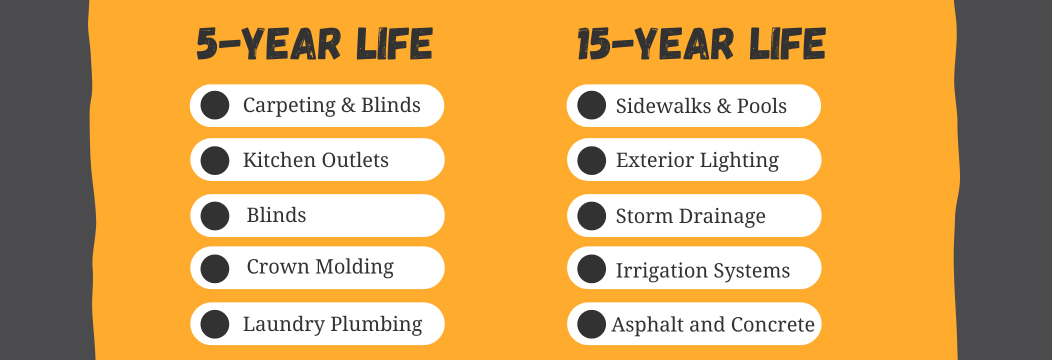

When acquiring, constructing or renovating multifamily properties, the asset is typically depreciated over 27.5 years. Cost segregation is the process of identifying, quantifying, and classifying assets of a property into shorter recovery depreciation lives, such as 5, 7 or 15-years. Doing so accelerates depreciation deductions which results in current year tax savings and increased cash flow.

What items at a multifamily property qualify for shorter lives?

A specialist is needed to complete cost segregation studies for multifamily properties to ensure that assets are accurately accounted for and classified. A quality cost segregation study will have tax references and other documentation to support their positions in case if challenged by the IRS. Examples of some items that would typically qualify for shorter life in a multifamily property include:

Let’s put some numbers to it:

A multifamily investor purchased a property with the following traits:

- Purchased in September of 2024

- $6 million purchase price with $1 million dedicated to non-depreciable land

- Garden style apartment property with clubhouse building

- Taxpayer with a 30% tax rate

The cost segregation study resulted in the following reclassification:

- 27.5-Year Property: $3,850,000

- 15-Year Land Improvements: $550,000 (11%)

- 5-Year Personal Property: $750,000 (15%)

As a result, $1,300,000 was reclassified into bonus-eligible shorter-term property, creating $830,000 in accelerated depreciation deductions. For the owner in the 30% tax bracket, this translated to $250,000 in immediate tax savings!

Who Should Consider Cost Segregation?

This strategy is ideal for:

- Multifamily investors who own properties with a basis of over $500,000.

- Properties undergoing or planning renovations or expansions.

- Owners planning to hold the property for at least 3-5 years.

Even if your property has been in service for years, it may not be too late! Missed depreciation from prior years can often be claimed in the current tax year with a 481(a) adjustment on the federal tax return. Align can assist with the proper forms and calculations that your tax preparer can implement into the tax return.

Ready to save?

Don’t let these opportunities pass you by. Align specializes in helping multifamily property investors maximize tax savings while staying fully compliant with regulatory requirements.

Contact Align today to see how much you can save with a cost segregation study. Let us help you turn tax strategies into profit strategies!